property tax assistance program montana

Property Tax Assistance Programs - Montana Department of Revenue Property Tax Assistance Programs October 12 2017 Notices Notices Adoption Notice PDF 20 KB. Montana has a Property Tax Assistance Program PTAP that helps residents with lower income reduce the property tax rates on their homes.

Tax Assistance Western Montana Area Vi Agency On Aging

Land Value Property Tax Assistance Program LVPTAP Montana Disabled Veteran Assistance Program MDV Natural Disaster.

. The first the Property Tax Assistance Program PTAP reduces residential property taxes for low-income households. 1 There is a property tax assistance program that provides graduated levels of tax assistance for the purpose of assisting citizens. That funding will help Montana.

Property Tax Relief Assistance and Reduction Programs. If you are already approved for the Property Tax Assistance Program you will not need to apply again. The Land Value Property Tax Assistance Program for Residential Property LVPTAP helps residential property owners if the value of their land is.

Improved Montana Property Tax Assistance Programs. You may use this form to apply for the Property Tax Assistance Program PTAP. This program applies solely to the first 200000.

AARP Foundation Tax-Aide is the largest free volunteer-run tax assistance and preparation program in the United States. Property tax assistance program -- fixed or limited income. Approved Software Providers Commercial.

The first the Property Tax Assistance Program PTAP reduces residential property taxes for low-income households. The income ranges are updated each year for inflation. To apply for this program print and fill out the application form.

In Montana we offer in-person tax preparation help to anyone for. The American Rescue Plan Act passed by Congress and signed by the president contains 9961 billion nationwide for a Homeowner Assistance Fund HAF. For questions on enrollment contact your local tax assistance office.

Approved Software Providers Commercial. Helena The Montana Department of Revenue wants to let property owners know about a. 1 The property owner of record or the property owners agent must make application to the local department office to receive the PTAP benefit provided for in 15-6-305.

The Free File Alliance allows commercial income tax software providers to offer free tax filing services to qualified taxpayers. As of Monday April 18th 2022 the Property Tax department has moved to the new Flathead County. The taxpayer must live in their home for at least.

Property Tax Assistance Program PTAP will reduce your tax obligation if you meet. The taxpayer must live in their home for at least seven months out of. July 2 2021.

Property tax relief-programs Appeal Process Protest Form We Have Moved. Return the completed application as instructed on the form. Property Tax Assistance Program.

A cash refund is based on the ratio between your income and what you have to pay in rent or taxes. 1 The requirements of this section must be met for a taxpayer to qualify for property tax assistance under 15-6-305 or 15-6-311. Property tax assistance -- rulemaking.

2 For the property. Depending on the marital status and income of the homeowner the tax rate is reduced by 80 50 or 30 of the normal tax rate. The Property Tax Assistance Program PTAP was created for property owners who need help paying off their taxes which can be quite high considering.

The Free File Alliance allows commercial income tax software providers to offer free tax filing services to qualified taxpayers.

Tax Breaks For Montana Property Owners Inspect Montana

Filing A Montana Income Tax Return Some Things To Know Credit Karma

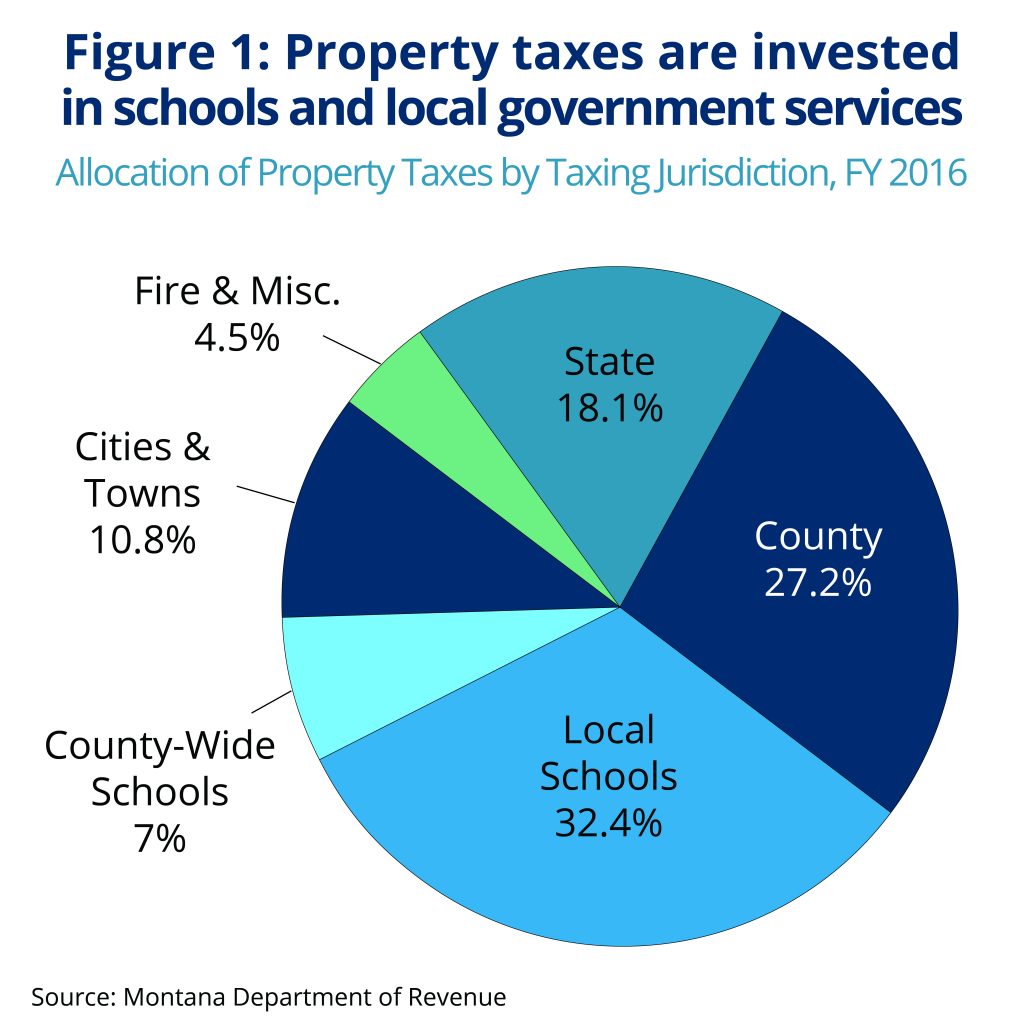

Policy Basics Property Taxes In Montana Montana Budget Policy Center

Low Income Assistance Programs Montana Dakota Utilities Company

Taxes Fees Montana Department Of Revenue

Montana State Taxes Tax Types In Montana Income Property Corporate

Montana Property Taxes Montana Property Tax Example Calculations

States Cut Taxes For Income Gas Property And Groceries Money

Calculator Shows Possible Tax Increase Of Illinois Labor Amendment Illinois Thecentersquare Com

Wednesday January 6 2021 Ad Western Montana Area Vi Agency On Aging Mineral County Valley Press Mineral Independent

First Time Homebuyer Programs In Montana Offer Tax Credits And Low Interest Loans

Franklin County Treasurer Star

Thousands Of Montanans Could Be Eligible For Property Tax Relief Explore Big Sky

Wildfire Recovery Resources Gallatin County Emergency Management

Montana State Tax Software Preparation And E File On Freetaxusa

Top 9 Montana Veteran Benefits

Thousands Of Montanans Could Be Eligible For Property Tax Relief Explore Big Sky

Montana Tax Institute Alexander Blewett Iii School Of Law University Of Montana